Neme Jimenez/iStock via Getty Images

The number of electric vehicle (EV) charging ports in the U.S. is estimated to increase four times from current levels to 18M by 2027, according to research firm Wood Mackenzie.

Most of those chargers are anticipated to be in the residential category, although the overall residential market share will slightly decline in that period as public and commercial segments grow.

The Wood Mackenzie report comes at a time when the EV charging space has been in the spotlight for weeks, with carmakers, EV charging companies and industry standards body SAE International signing up to incorporate Tesla’s (TSLA) North American Charging Standard (NACS) connector.

“Public EV charging networks are looking to establish and secure their footholds through aggressive expansion plans, innovative financing structures, and partnerships with automakers and other brick-and-mortar businesses,” Wood Mackenzie research analyst Nick Esch said in a statement on Wednesday.

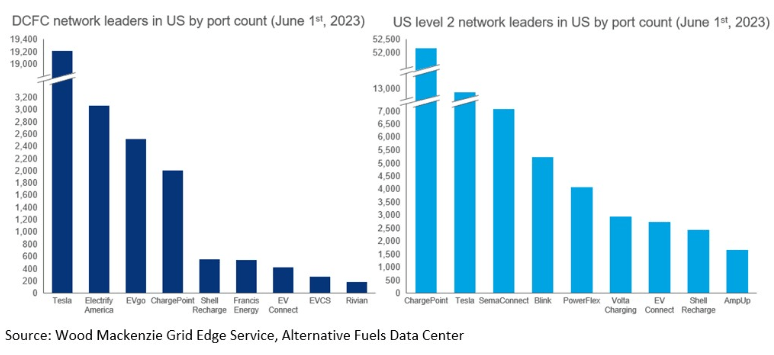

According to the report, Tesla (TSLA) and ChargePoint (CHPT) currently dominate the charging ports market, with the former claiming a 61% market share of DCFC ports in the U.S. Meanwhile, CHPT leads with a 46% market share of level 2 ports, which Wood Mackenzie defines as EV chargers with a charge rate between 3 kW and 19 kW of AC power.

U.S. President Joe Biden’s administration, as part of goals to combat climate change, hopes to have EVs make up at least 50% of new car sales by 2030 and plans to build a national network of 500K chargers. There are currently over 130K public chargers across the country.

Biden’s Bipartisan Infrastructure Law has outlined investments of $7.5B in EV charging and over $7B in EV battery components, critical minerals and materials.

The Wood Mackenzie report acknowledged that the recent announcements by companies such as Ford (F), General Motors (GM) and Rivian (RIVN) to adopt Tesla’s (TSLA) NACS connector signals the industry’s move towards making it a standard.

The report also highlighted the growth potential of deploying EV charging infrastructure in brick-and-mortar locations, calling it an “untapped market.”

“There is so much opportunity in the brick-and-mortar segment as it has synergies with EV charging. It is estimated that 85-90% of the U.S. population lives within 10 miles of major retailers, making them very convenient charging locations for EV drivers,” said Wood Mackenzie analyst Amaiya Khardenavis.

Other EV charging stocks: EVgo (EVGO), Wallbox (WBX), Blink Charging (BLNK), Proterra (PTRA) and Allego (ALLG).